Instructions Basic Abnormal Return Calculator

The basic Abnormal Return Calculator (bARC) makes it easy and fast to conduct a basic event study. It is free but only provides results at the AR-level and does not provide any test statistics. It follows the same workflow as the advanced Abnormal Return Calculator, which is described below and in our Medium article "How to perform a Return Event Study with EventStudyTools".

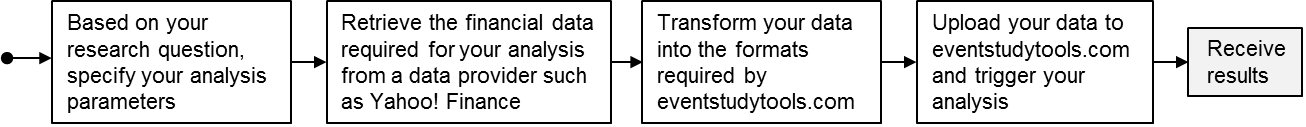

Our abnormal return calculators require you to upload three files that contain all the data and information needed for your event study. Statistical analyses are then performed server-side and you receive the analysis results as attachments to an email (see Figure 1 for an illustration of this workflow). As for your input, you need to provide an 'analysis request file' that specifies your analysis parameters, a 'firm data file' which holds the firm financial data that is required for your analysis, and a 'market data file' that holds the respective capital market data. You can upload the files in xls, xlsx, and csv (standard, not UTF-8) file formats, either uncompressed or ZIP-compressed. For creating the firm and market data files, you need financial data, which you can retrieve either from a financial data website (e.g., Yahoo!Finance) or through our firm and market data files compilation service.

Figure 1: Event Study Workflow of EventStudyTools

Your three input files must comply with a certain internal structure so that our abnormal return calculators can process these files. Table 1 describes this data structure. Also, the following example files![]() may help as templates when constructing your own files. Table 2 describes the content of the result files you will receive after the bARC application has performed its calculations.

may help as templates when constructing your own files. Table 2 describes the content of the result files you will receive after the bARC application has performed its calculations.

| CSV | BENCHMARK MODEL | ITEMS TO BE INCLUDED (TO BE SEPARATED BY A SEMICOLON ) |

|---|---|---|

| Request File | Same structure for all expected return models | Event ID; Firm ID; Market ID; Event Date; Grouping Variable2; Start Event Window3; End Event Window3; End of Estimation Window3; Estimation Window Length |

| Firm Data | Same structure for all expected return models | Firm identifier; Date; Closing price |

| Market Data |

For all models but Fama-French models: |

Market identifier; Date; Closing price |

| For the Fama-French 3-Factor Model: | Market identifier; Date; Closing price; Rf; smb; hml | |

| For the Fama-French Momentum-4-Factor Model: | Market identifier; Date; Closing price; Rf; smb; hml; umd |

1 Formats of input variables: Please use integer values as firm and market identifiers. The identifiers in the request file must be unique. There is no specific format you have to follow; just make sure that the identifiers you use in the firm and market data CSVs match the ones you use in the analysis request CSV. The dates you provide, however, need to be in a distinct date format. Please use either YYYY-MM-DD (default of Yahoo!Finance) or DD.MM.YYYY (Excel default in many countries). If you should use a date format different from these two, the ARC will prompt an error message in its report.

2 For generating the 'average' values in your analysis (i.e., AAR and CAAR values as produced by aARC), you need to specify the 'grouping variable'. If you use only one value in the grouping variable, which is the default case, AXC will calculate the average values across all events in your request file; if you choose more than one value (e.g., 'acquisition' and 'divestiture'), AXC will produce average values across the events grouped by these values.

3 These variables hold figures relative to the event date. ‘Start Event Window’ and ‘End Estimation Window’ typically lie before of the event date therefore must have a negative sign or be zero. Ranges of allowed values: ‘Start Event Window’: [-50, 0]; ‘End Event Window’: [0, 50]; ‘End Estimation Window’: [-unlimited, -1]; you may choose any (positive) length of the estimation window.

| APP | OUTPUT FILE | ITEMS REPORTED (SEPARATED BY A SEMICOLON) |

|---|---|---|

| bARC | Analysis Results | Event ID; ...; AR(-1); AR(0); AR(1); ...; t-value [AR(-1)]; t-value [AR(0)]; t-value [AR(1)]; ... |

| Analysis Report | Event ID; Firm; Reference Market; Event Date; Analysis Report; Estimation Window Length; End of Estimation Window; First Date Estimation Window; Last Date Estimation Window; Actual Stock Return; Actual Market Return; Alpha; Beta; Residual Standard Deviation; Expected Market Return |

The output files are prompted to you right on the website and come in CSV file format. As you can see, bARC provides you with very basic results at the AR-level only (i.e., abnormal returns and their corresponding t-values, as well as the coefficients and values used/generated in the calculation). Table 3 contrasts this with the outputs of our regular Abnormal Return Calculator (ARC), which adds results and various test statistics at the AAR-, CAR-, and CAAR-level.

| APP | AVAILABLE RETURN MODELS | RETURN CALCULATION | RESULT LEVELS | TEST STATISTICS | NON TRADING DAY ADJUSTMENT | RESULTS DELIVERY |

|---|---|---|---|---|---|---|

| bARC | market model | log-returns | AR | AR t-test | no auto-adjustment | prompted to screen |

| aARC | market model |

log- or simple returns |

AR, AAR, CAR, CAAR, BHAR |

T-tests, Patell-test, Adjusted Patell-test, BMP-test, Adjuted BMP-test, Cowan GSIGN-test, Corrado Rank-test, GRANK-t-test, GRANK-z-test, Skewness adjusted test |

optional auto-adjustment (earlier/later) | prompted to screen, e-mail delivery |